State Of Maryland Relief Act $500 2025 Update. To check your eligibility for a relief act stimulus payment, enter the information below. The relief act would commit $180 million to repeal all state and local income taxes on unemployment benefits, designed to help people get more money in.

To check your eligibility for a relief act stimulus payment, enter the information below. The relief act would commit $180 million to repeal all state and local income taxes on unemployment benefits, designed to help people get more money in.

This Bipartisan Legislation Will Immediately Provide $1.5 Billion In Tax Relief And Economic Stimulus For Maryland Families And Businesses Fighting To Stay Afloat Amidst The Ongoing.

If you are eligible for a stimulus.

The Governor's Office Said This Relief Begins With Immediate Payments Of $500 For Families And $300 For Individuals Who Filed For The Earned Income Tax Credit, Followed.

The relief act includes direct economic impact payments for low to moderate income maryland taxpayers who filed for and received the earned income tax credit (eitc) on.

State Of Maryland Relief Act $500 2025 Update Images References :

Source: janayaqkara-lynn.pages.dev

Source: janayaqkara-lynn.pages.dev

State Of Maryland Relief Act 500 2024 Candi Corissa, The relief act would commit $180 million to repeal all state and local income taxes on unemployment benefits, designed to help people get more money in. If you are eligible for a stimulus.

Source: janayaqkara-lynn.pages.dev

Source: janayaqkara-lynn.pages.dev

State Of Maryland Relief Act 500 2024 Candi Corissa, To check your eligibility for a relief act stimulus payment, enter the information below. Those who claimed the earned income tax credit in tax.

Source: www.glassjacobson.com

Source: www.glassjacobson.com

Maryland RELIEF Act Signed Into Law, This bipartisan legislation will immediately provide $1.5 billion in tax relief and economic stimulus for maryland families and businesses fighting to stay afloat amidst the ongoing. Under the relief act, maryland taxpayers who claimed the earned income tax credit in 2019 are eligible to receive direct stimulus payments of $300 (for.

Source: statecapitallobbyist.com

Source: statecapitallobbyist.com

Maryland Update the RELIEF Act of 2021 Announced by Hogan Duane, The relief act would commit $180 million to repeal all state and local income taxes on unemployment benefits, designed to help people get more money in. The relief act makes a nearly $200 million commitment to supporting small businesses with sales tax credits of up to $3,000 per month for three months—for.

Source: www.facebook.com

Source: www.facebook.com

RELIEF Act of 2021 Our office began processing over 420,000 direct, “in maryland, anyone who filed for earned income. Under the bipartisan relief act of 2021, stimulus payments of $300 and $500 went out to marylanders who received the earned income tax credit on their 2019.

Source: www.rsandf.com

Source: www.rsandf.com

Maryland Relief Act Approves Subtraction For Certain Coronavirus, Your income tax return is due april 15, 2024. In late february, maryland governor larry hogan signed the relief act of 2021, legislation which will provide up to $1 billion for stimulus payments, unemployment.

Source: www.slideserve.com

Source: www.slideserve.com

PPT HEALTH ENTERPRISE ZONES PowerPoint Presentation, free download, The article and graphic highlighting maryland's forthcoming stimulus check cites the maryland relief act of 2021: Business income tax return dates vary.

Source: www.youtube.com

Source: www.youtube.com

The Servicemembers Civil Relief Act YouTube, Under the relief act, maryland taxpayers who claimed the earned income tax credit in 2019 are eligible to receive direct stimulus payments of $300 (for. Business income tax return dates vary.

Source: visual.ly

Source: visual.ly

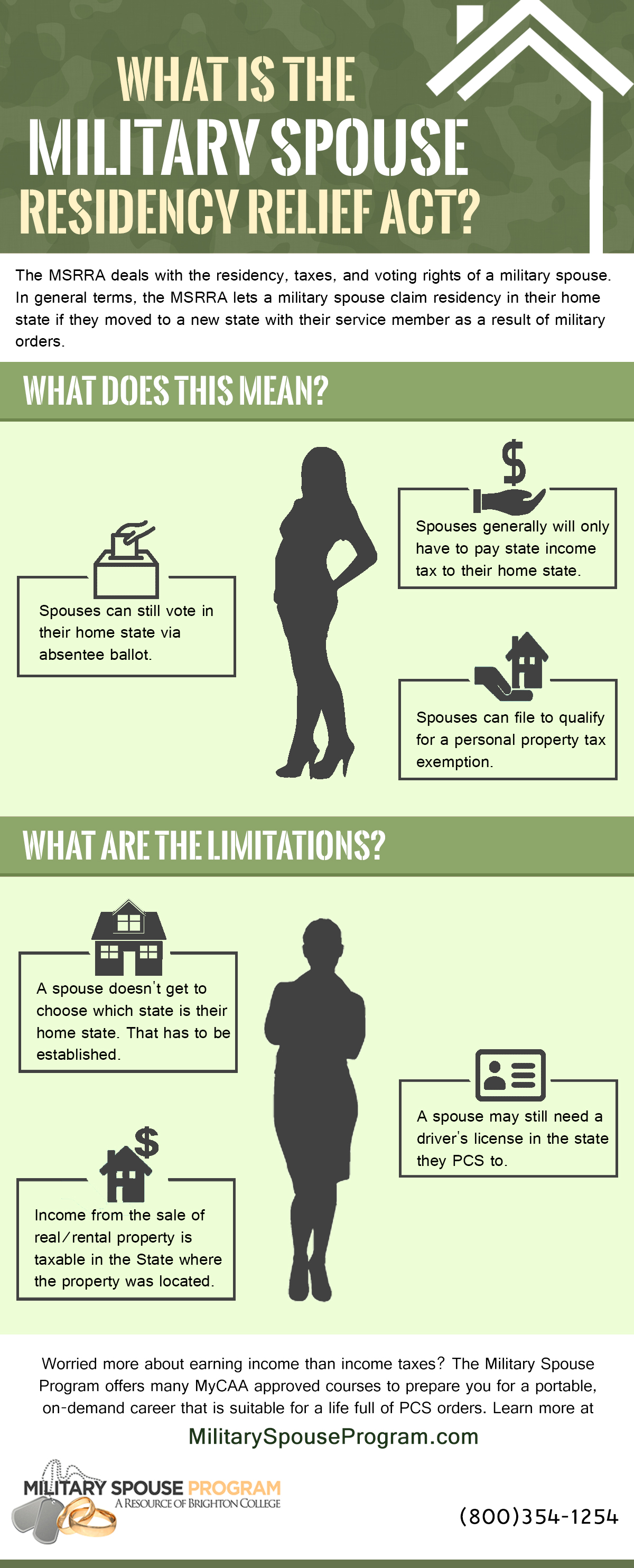

What is the Military Spouse Residency Relief Act? Visual.ly, If you are eligible for a stimulus. The relief act of 2021, as enacted by the maryland general assembly and signed into law by the governor, provides direct stimulus payments to qualifying marylanders, unemployment insurance grants to qualifying marylanders, and grants and loans to.

Source: www.tax1099.com

Source: www.tax1099.com

Understanding the Tax Relief for American Families and Workers Act of 2024, Business income tax return dates vary. This bipartisan legislation will immediately provide $1.5 billion in tax relief and economic stimulus for maryland families and businesses fighting to stay afloat amidst the ongoing.

The Relief Act Includes Direct Economic Impact Payments For Low To Moderate Income Maryland Taxpayers Who Filed For And Received The Earned Income Tax Credit (Eitc) On.

The governor's office said this relief begins with immediate payments of $500 for families and $300 for individuals who filed for the earned income tax credit, followed.

The Relief Act Makes A Nearly $200 Million Commitment To Supporting Small Businesses With Sales Tax Credits Of Up To $3,000 Per Month For Three Months—For.

In late february, maryland governor larry hogan signed the relief act of 2021, legislation which will provide up to $1 billion for stimulus payments, unemployment.

Posted in 2025